View pictures in App save up to 80% data.

Even though their home avoided any damage from two recent wildfires, one family in Arizona was dismayed to learn that their insurance provider was still dropping them due to significant fire risk — leaving them high and dry in the event of a disaster.

What occurred?

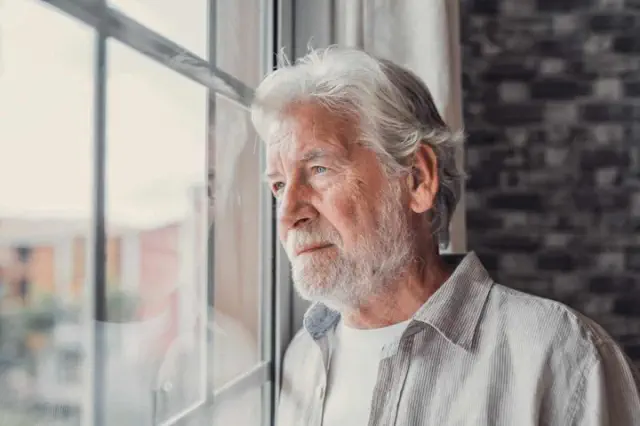

In the last year-and-a-half, over 2,100 acres have burned in the greater Phoenix area, local station 12 News reported. While resident Kevin O'Neil was lucky enough to avoid any damage to his home during that time, he still encountered a major issue.

"My wife got a letter," O'Neil shared with 12 News. "It stated, 'Because of the fire situation, we won't be renewing your policy.' I couldn't believe it."

While conversing with fellow members of his community, he discovered that many families were facing similar circumstances.

"I understand. The insurance companies are in the business of making profits," he remarked. "We all have to earn a living. However, these are our residences."

Similar situations have been cropping up around the country — from states with high fire risk to coastal areas vulnerable to severe hurricane damage, floods, and tornadoes.

Why is the removal of insurance coverage so alarming?

What makes this predicament so troubling, scientists warn, is that all of these natural disasters — from fires to floods — are exacerbated by human-driven global heating.

The combustion of fossil fuels has resulted in an alarming increase of heat-trapping gases in the atmosphere, subsequently giving rise to a weather-enhancing phenomenon referred to as the greenhouse effect.

This means that, as humans continue to produce emissions — through everything from transportation to manufacturing — hurricanes are continuing to grow more severe, droughts last longer, and wildfires blaze hotter. All of these issues put homes at risk.

🗣️ In your opinion, is the United States facing a housing crisis?

🗳️ Select your option to view the outcomes and share your thoughts!

What actions can be taken?

Unfortunately, when it comes to assessing home insurance in disaster-prone areas, there is no obvious solution.

While most states offer a state-backed "plan of last resort," these have quickly become overwhelmed by the vast number of homeowners seeking their coverage. In order to assess the issue and determine possible solutions, organizations like Arizona's Mitigation and Resiliency Council are being formed.

In the council's first meeting, members pointed out that new homes are still being built in fire-prone areas, meaning fire prevention and mitigation efforts are going to become even more expensive — and insurers may be incentivized to drop entire areas even more quickly because of it.

While experimenting with disaster-proof building materials is a worthwhile effort in the short term, having governments and corporations work to reduce their planet-warming emissions in a timely, organized way is the only true solution for the underlying problem.

View pictures in App save up to 80% data.

Join our free newsletter for good news and useful tips, and don't miss this cool list of easy ways to help yourself while helping the planet.