View pictures in App save up to 80% data.

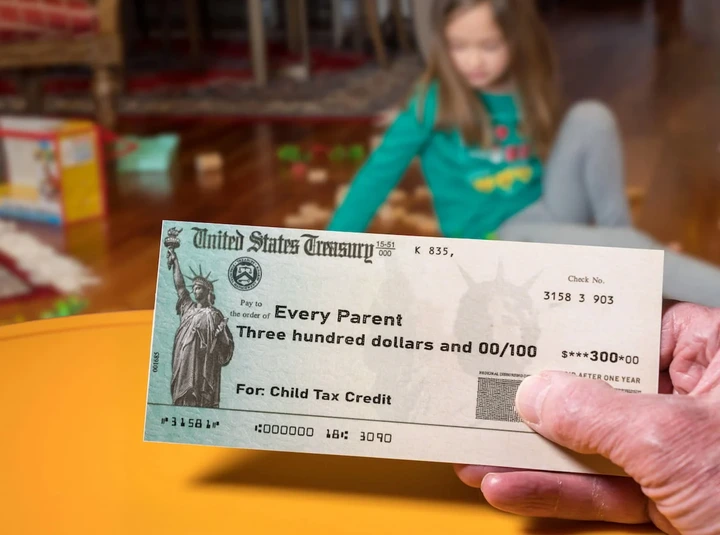

Millions of families across the U.S. are receiving up to $300 per child each month in 2024, thanks to the expanded Child Tax Credit (CTC) program under the American Rescue Plan. These payments are helping households manage rising costs, providing crucial financial relief for parents with children under 18. Here’s how to check your eligibility, when payments will arrive, and what you need to do to claim yours.

Who is Eligible for the $300 Payments?

To qualify for these payments, your eligibility is determined by your income level and the number of dependent children in your household:

- Income Limits:

- Single filers earning up to $75,000.

- Head of household filers earning up to $112,500.

- Married couples filing jointly earning up to $150,000.

Payments decrease for individuals whose earnings surpass these thresholds.

- Qualifying Children:

- Children under 6 years old qualify for $300 per month.

- Children aged 6 to 17 qualify for $250 per month.

- Dependents must have a valid Social Security Number and live with the taxpayer for at least six months of the year.

What is the schedule for sending payments?

- Payments are distributed monthly on the 15th of each month.

- If the 15th falls on a weekend or holiday, payments will arrive the prior business day.

- Payments are issued via direct deposit, paper check, or prepaid debit card, depending on your filing information.

Steps to Claim Your Payments

- File Your Taxes: Ensure your 2023 tax return is submitted, as the IRS uses this data to calculate your eligibility and payment amounts.

- Update Your Information: Use the IRS Child Tax Credit Update Portal to report changes in income, marital status, or dependents.

- Non-Filers: Submit a simplified tax return through the IRS to enroll in the program.

Further Information

- Split Payments: Monthly payments represent half of the total credit. The remainder can be claimed when filing your 2024 tax return.

- Opt-Out Option: Families who prefer a lump sum payment can opt out of monthly payments through the IRS portal.

The Importance of This Issue

The enhanced Child Tax Credit has served as a crucial support system for countless families, enabling them to manage necessary expenses such as housing, childcare, and food. This initiative aims to promote enduring financial security for families across the United States.